Encina Lender Finance Promotes Avnir to Chief Commercial Officer

Encina Lender Finance promoted Dan Avnir to chief commercial officer. Avnir had previously served as managing director of originations for the firm. In Avnir’s new role, he will continue to lead Encina Lender Finance’s origination strategy across its commercial and...Encina Lender Finance Closes $25MM Warehouse Facility for Doc2Doc

Doc2Doc, a leading LendTech company focused on the medical space, announces the closing of a new $25 Million warehouse facility to help further growth, provided by Encina Lender Finance. “We are ecstatic to be able to help more members, and grateful for our...Encina Lender Finance Expands Executive Leadership Team with New Hires, Graham Steps Down

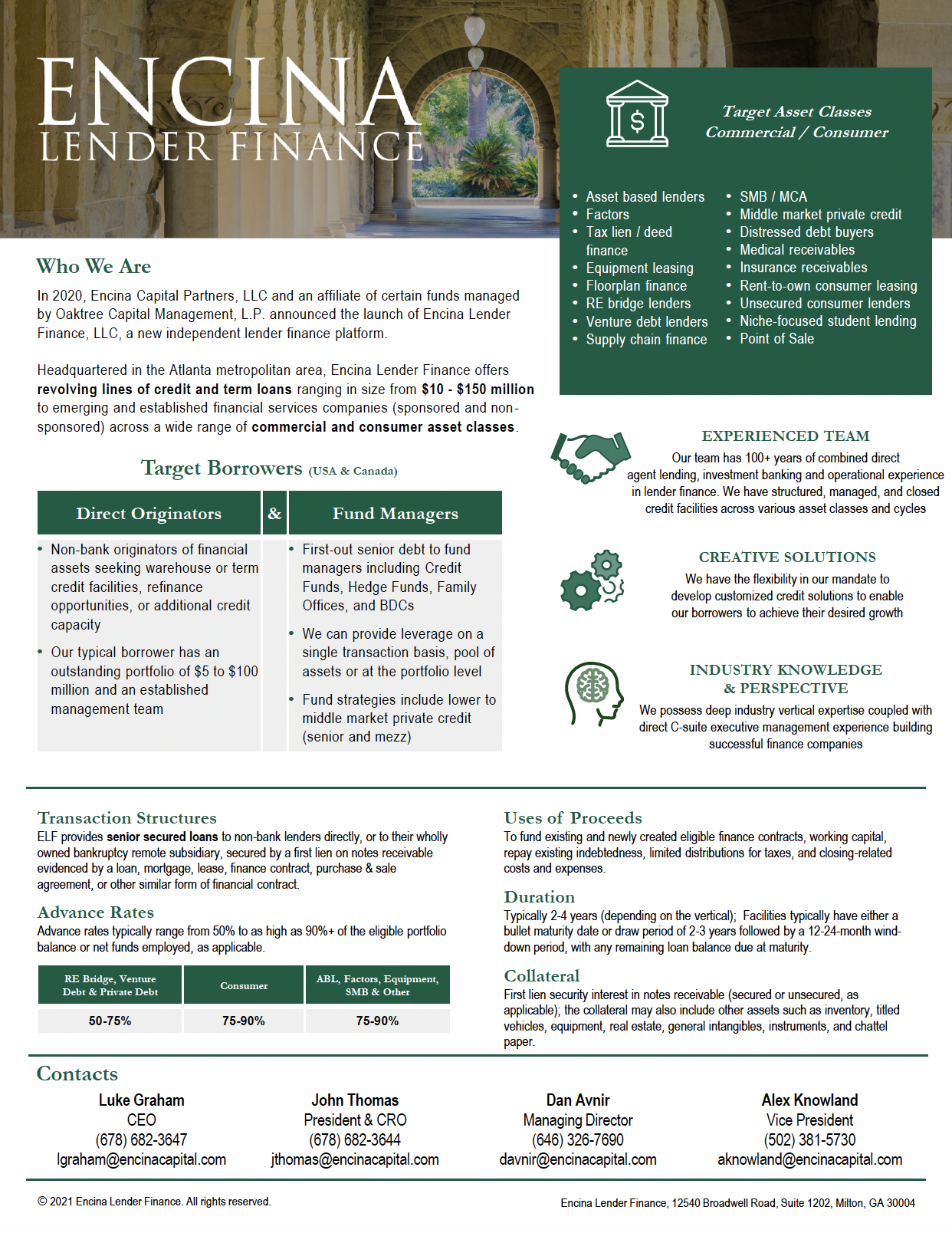

In October 2020, Encina Capital Partners, LLC and an affiliate of certain funds managed by Oaktree Capital Management, L.P. announced the formation of Encina Lender Finance, a new independent lender finance platform targeting commercial and consumer specialty finance companies in the U.S. and Canada.

Encina Lender Finance – Finding Success in a Challenging Environment

In October 2020, Encina Capital Partners, LLC and an affiliate of certain funds managed by Oaktree Capital Management, L.P. announced the formation of Encina Lender Finance, a new independent lender finance platform targeting commercial and consumer specialty finance companies in the U.S. and Canada.

Stride Funding Partners with Encina Lender Finance and Other Leading Credit Investors to Fund $105MM in Income Share Agreements for High-Quality Bootcamp and Certificate Programs

BOSTON, April 4, 2022 /PRNewswire/ — Stride Funding, Inc. (Stride) announced its partnership with Encina Lender Finance (ELF) and other top-tier credit funds to increase financial support for students pursuing high-impact bootcamp and certificate programs across the US.