Atlanta, GA and San Francisco, CA – March 20, 2025 – Encina Lender Finance, LLC (“ELF”) announced today a $125 million upsized credit facility commitment to a non-prime credit card platform. In connection with this transaction, ELF recruited a like-minded partner and ABF co-investor to join the credit facility.

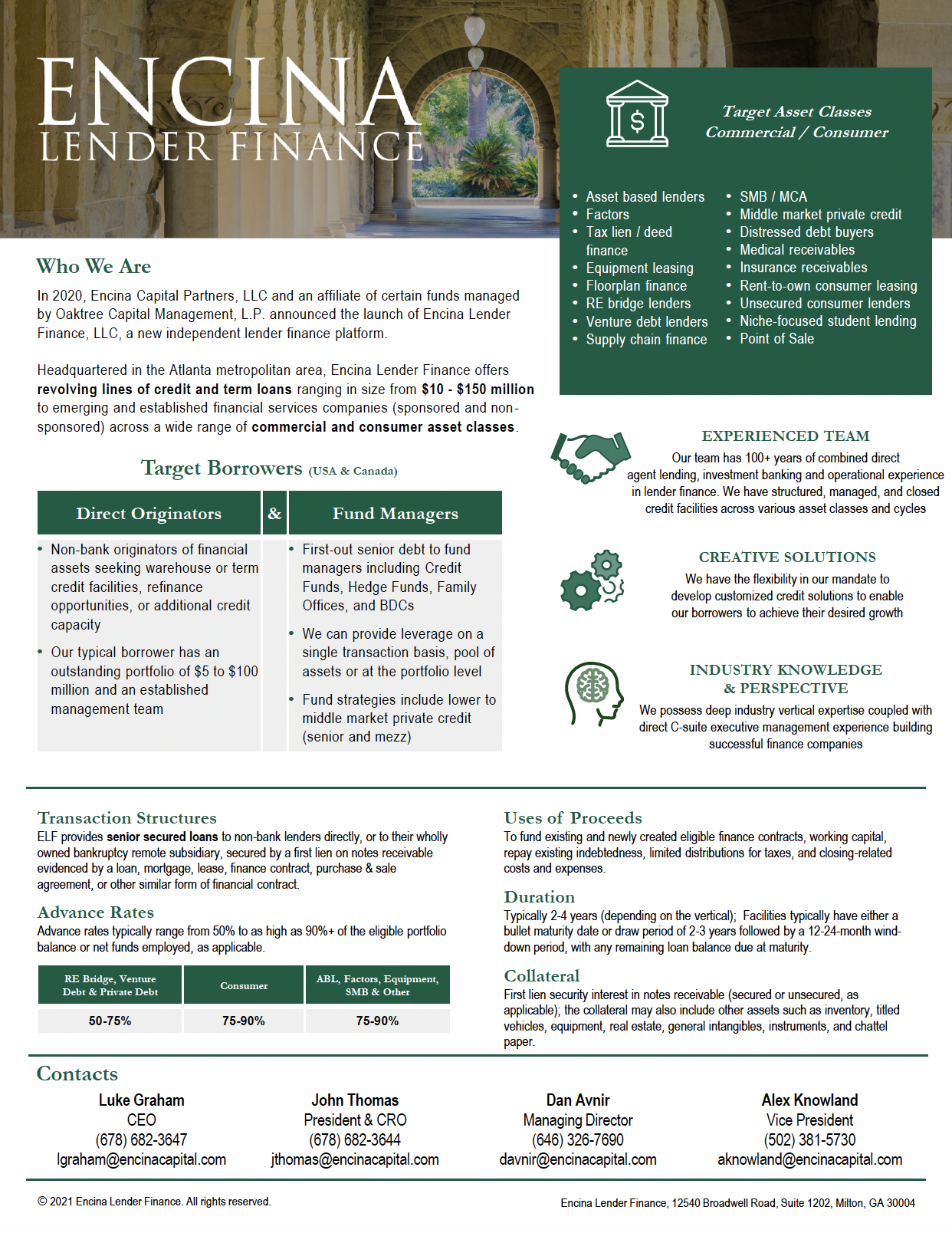

About Encina Lender Finance

Operating from both coasts, ELF offers delayed draw term loans and forward flow purchase programs ranging in size from $50 – $150 million to emerging and established specialty finance companies with strong junior capital sponsorship. ELF targets ABF investments in granular pools of short-to-intermediate duration asset classes in the consumer and commercial finance sectors. Targeted consumer asset classes include unsecured installment and revolving loans (direct-to-consumer and point-of-sale), secured vehicle finance, home improvement loans, rent-to-own/lease-to-own, debt consolidation loans, and student lending (in-school vocational, refi). Targeted commercial asset classes include small balance SMB lending (both direct-to-business and embedded point-of-sale), merchant cash advance, small-ticket equipment finance, corporate charge card, earned wage access, and supply chain/trade finance. In addition, ELF provides streamlined “first-out” financing to other like-minded private credit investors in the specialty finance sector. ELF utilizes a combination of cutting-edge technologies and rigorous collateral-level analysis to generate differentiated investment insights and creative solutions to its counterparties’ credit portfolio financing needs. For additional information, please visit ELF’s website at: https://lenderfinance.encinacapital.com.