Atlanta, GA – February 14, 2022 – Encina Lender Finance, LLC (“ELF”) and Georgia Banking Company (GBC) announced today that they have provided a $40 million senior credit facility to Microf LLC (“Microf”), a leading provider of rent-to-own and lease-purchase solutions for residential HVAC systems. The credit facility was used to refinance existing credit facilities and to expand debt capacity to fund Microf’s continued growth.

Headquartered in Roswell, Georgia and founded in 2010, Microf is a national market leader in providing rent-to-own or lease-purchase solutions for residential HVAC systems to merchants and their consumers through retail, wholesale and direct-to-consumer channels. The company also offers HVAC merchants value-added technology platform services to maximize incremental sales through a streamlined financing and leasing application.

“We chose to work with ELF and GBC because of the teams’ expertise with Lease to Own and familiarity with our assets, business and operations,” said Zenon Olbrys, Chief Executive Officer of Microf. “This relationship lines us up with partners who support our growth and product expansion plans. It provides us the ability to innovate on product development and enter new business

verticals. Further, the fact that ELF and GBC are local Atlanta-based companies allows us to meet and discuss issues when needed, which is certainly a unique luxury in today’s times.”

“Encina Lender Finance is pleased that the Microf team has trusted us and GBC to help them expand their already successful platform,” stated Luke Graham, Chief Executive Officer of ELF. “Microf has developed a terrific product suite that adds significant value to merchants and their consumers, and we look forward to working with Zenon and his team to continue scaling their business.”

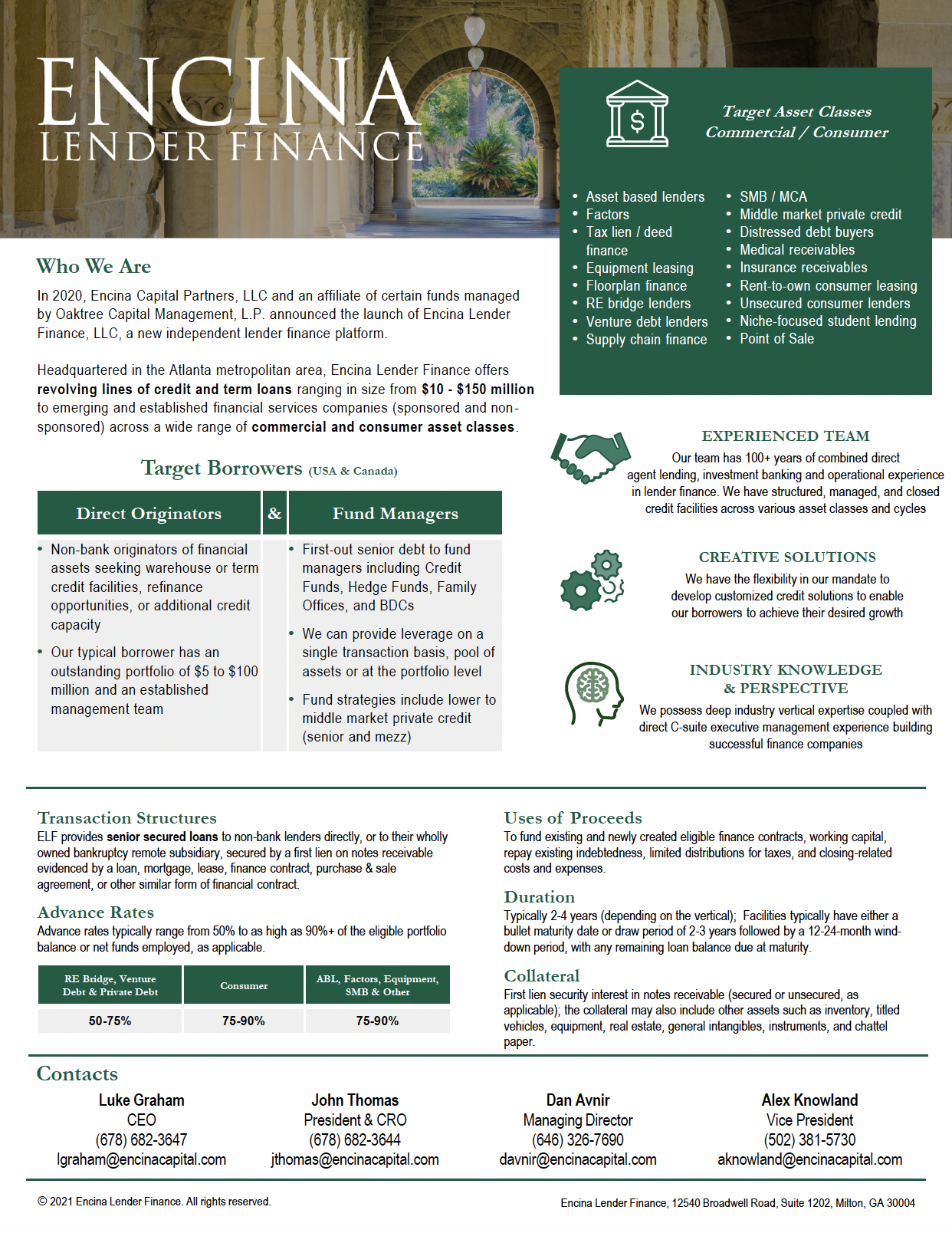

About Encina Lender Finance

Headquartered in Atlanta, ELF offers revolving lines of credit and term loans ranging in size from $10 to $150 million to specialty finance companies (sponsored and non-sponsored) across a wide range of asset classes including, but not limited to, asset-based lending, factoring, equipment leasing, floorplan financing, commercial real estate bridge lending, tax lien/deed financing, venture debt lending, SMB lending & merchant cash advance, middle-market private credit, charged-off debt buyers, rent-to-own consumer leasing, unsecured consumer lending and specialized student lending. ELF’s customers use financing proceeds primarily to fund the origination of new finance contracts and to refinance existing debt, and ELF’s loans are secured by portfolios of notes, loans and/or leases. For additional information, please visit ELF’s website at https://lenderfinance.encinacapital.com.

About Georgia Banking Company

Georgia Banking Company (GBC) is a full-service, commercial community bank headquartered in Atlanta, Georgia with assets of approximately $1.2 billion as of December 31, 2021. Led by fifth generation banker, CEO Bartow Morgan, Jr., GBC’s team of veteran Atlanta bankers are focused on leveraging technology to deliver an exceptional service experience to meet the needs of growing businesses and private banking clients. For additional information, please visit GBC’s website at https://geobanking.com.

About Microf

Headquartered in Roswell, Georgia and founded in 2010, Microf is a national market leader in providing rent-to-own or lease-purchase solutions for residential HVAC systems to merchants and their consumers through retail, wholesale and direct-to-consumer channels. The company also offers HVAC merchants value-added technology platform services to maximize incremental sales through a streamlined financing and leasing application. For additional information, please visit Microf’s website at https://microf.com.