In this second installment of a quarterly ABL Advisor article series, Charlie Perer meets with commercial finance industry professionals to discuss the state of the lender finance industry and general market dynamics. The objective of this series is to engage with a panel of industry leaders specializing in lender finance, with the aim of gaining insights into their perspectives on the market and understanding their strategic business positioning.

Here to tell the story are Edward Chang, Chief Executive Officer of Encina Lender Finance, Steven Katz, Managing Director, Commercial Lender Finance with Texas Capital Securities, Kenneth Taratus, Managing Director of Keefe, Bruyette & Woods and Mitch Soiefer, Partner, Head of Lender Finance with SLR Capital Partners.

Charlie Perer: To begin, please briefly introduce yourselves.

Ken Taratus: I am the head of private debt placements at Keefe, Bruyette and Woods (“KBW”) where I work with both balance sheet lenders and balance sheet light companies in the financial services and fintech sectors.

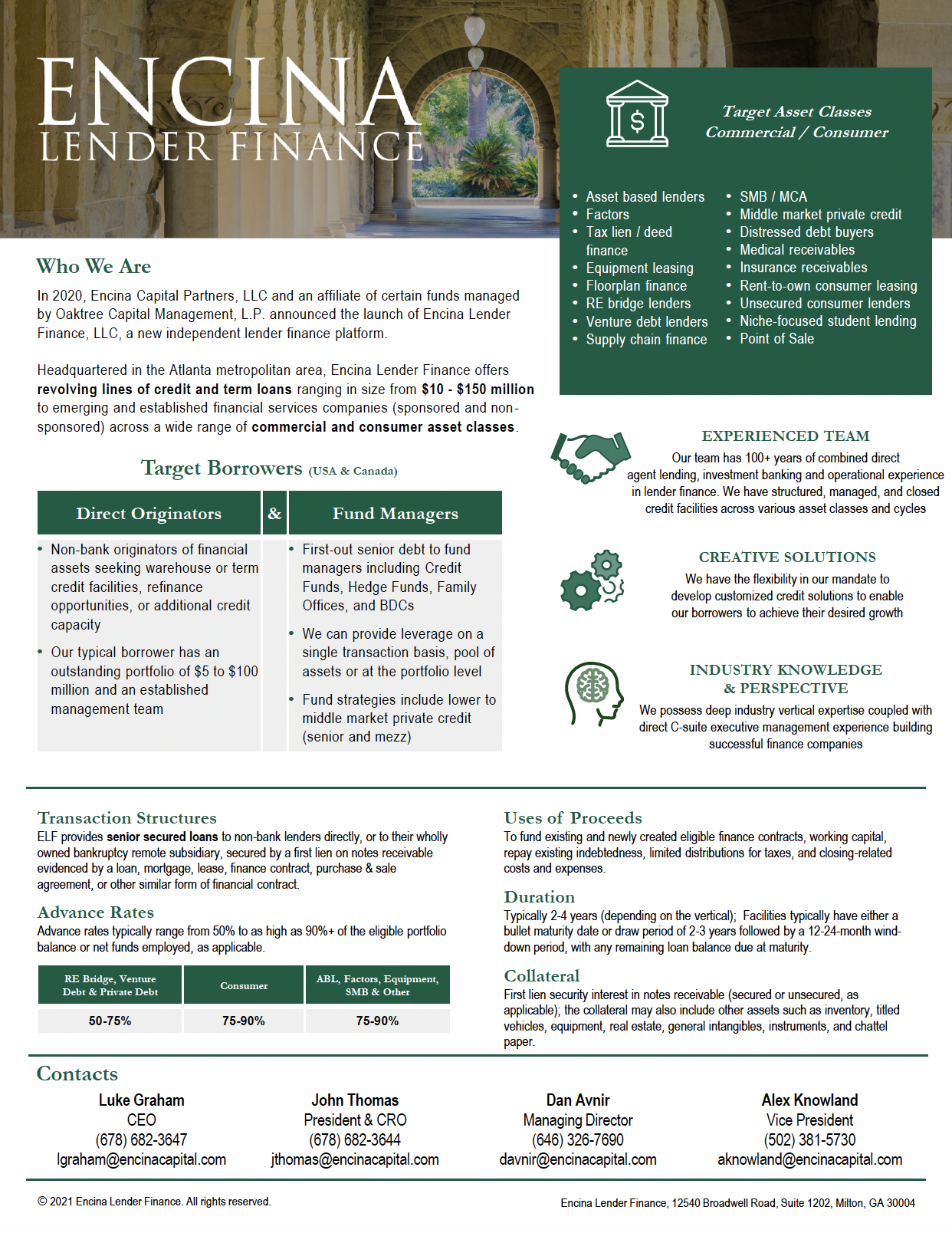

Ed Chang: I am the CEO of Encina Lender Finance (ELF). Under our commercial vertical, ELF lends to ABL, factoring and equipment finance companies. ELF also lends to consumer finance companies across a broad spectrum of asset classes including credit cards, installment loans and secured vehicle financing.

Mitch Soiefer: I am the head of Lender Finance at SLR Capital Partners and am in my fifteenth year with the SLR Platform. We provide both debt and equity investments to commercial finance companies.

Steven Katz: I am head of the Commercial Lender Finance business at Texas Capital, a group that was started about 4 years ago to complement the firm’s existing Consumer Lender Finance business, which has been an active group for 20 years. I have been involved in specialty finance my entire career which includes working within investment banking, bond insurance and bond ratings. I have specifically been involved in lender finance for 15 years, starting at Wells Fargo Lender Finance.

Perer: How has the lender finance market evolved since 2008?

ABL Advisor article with Edward Chang – Chief Executive Office – Encina Lender Finance

Chang: In 2008, the lender finance market did not exist as we know it today. There were very few institutions that specialized in lending to traditional commercial finance companies. Over the last decade, the market has grown exponentially, with a proliferation of entrants across bank and non-bank institutions.

Soiefer: The demand for lender finance capital has grown substantially since 2008. Of note, there has been a continued movement toward direct lenders such as SLR, which has more flexible capital to meet that demand. We are talking to many more mid-size finance companies today than in 2008 as several platforms have launched outside of banks with a focus on specific market niches, and our firm has the expertise to underwrite these niches.