NEW YORK – Saratoga Investment Corp. (NYSE:SAR) (“Saratoga Investment” or “the Company”), a business development company, today announced that its wholly-owned subsidiary, Saratoga Investment Funding II LLC (“SIF II”), an entity formed for purposes of entering into this financing arrangement, closed a new $50.0 million senior secured credit facility (the “Facility”) with Encina Lender Finance, LLC (“Encina”). The Facility will be supported by loans held by SIF II and pledged to Encina under the terms of the credit agreement.

The Facility closed on October 4, 2021. SIF II may request an increase in the commitment amount to up to $75.0 million during the first two years. The terms of the Facility require a minimum drawn amount of $12.5 million at all times during the first six months, which increases to the greater of $25.0 million or 50% of the commitment amount in effect at any time thereafter. The term of the Facility is three years. The interest rate on the borrowings under the Facility is LIBOR plus 4.0%, with LIBOR having a floor of 0.75%. Concurrently with the closing of this Facility, all remaining amounts outstanding on the Company’s existing revolving credit facility with Madison Capital Funding, LLC were repaid and the facility terminated.

“We are pleased to close this credit facility with Encina, which provides the Company with a great deal of flexibility as we assess our needs and seek to optimize our overall capital structure. Encina has been an excellent partner in this process, and we appreciate the opportunity to establish this new relationship with them,” said Christian L. Oberbeck, Chairman and Chief Executive Officer of Saratoga Investment.

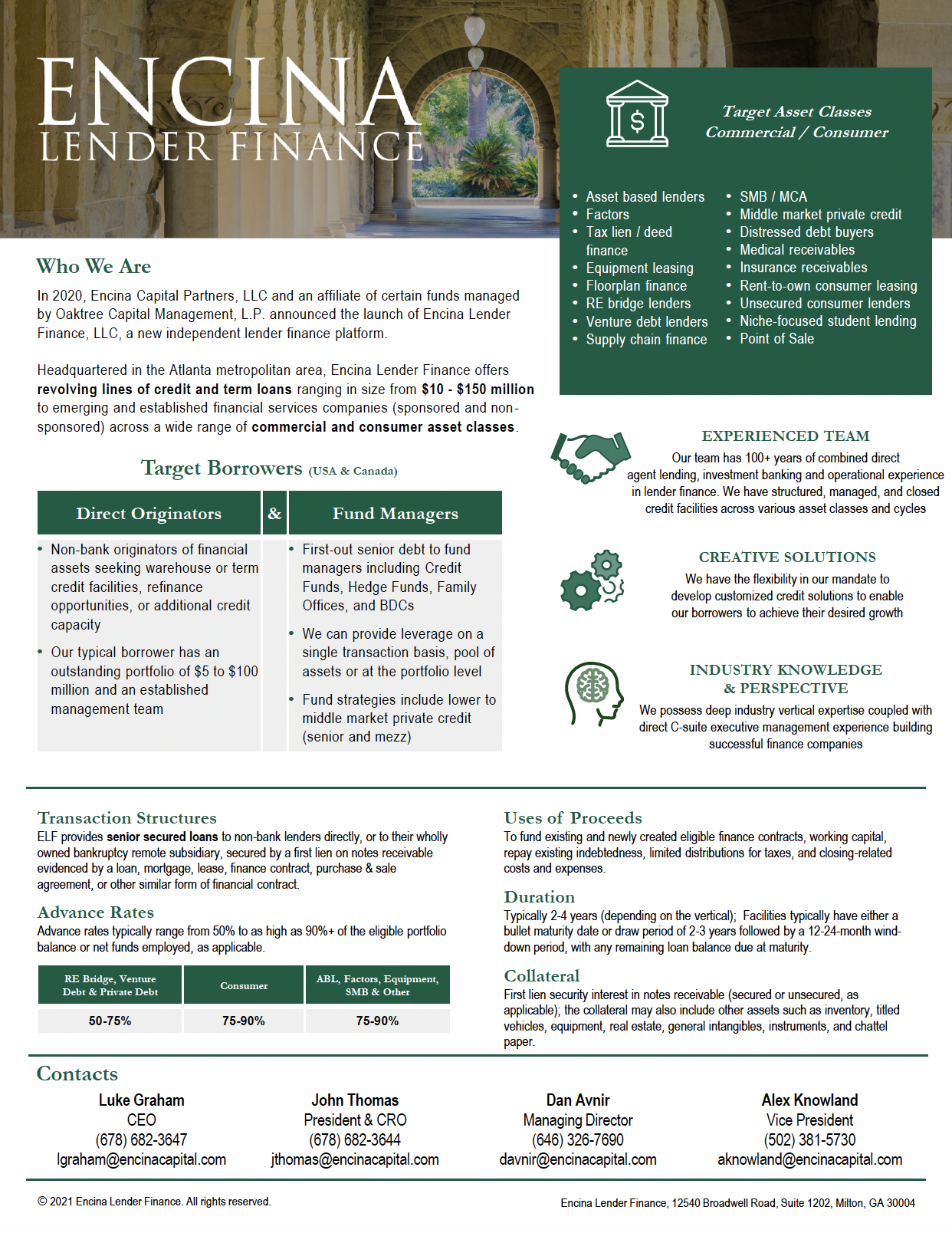

“Encina Lender Finance is pleased that Saratoga Investment has selected us as a key senior debt capital partner,” said Luke Graham, Chief Executive Officer of Encina. “The Company’s management team has a long and distinguished track record of success, and we look forward to supporting them in achieving Saratoga Investment’s future goals and objectives.”

About Saratoga Investment

Saratoga Investment is a specialty finance company that provides customized financing solutions to U.S. middle-market businesses. The Company invests primarily in senior and unitranche leveraged loans and mezzanine debt, and, to a lesser extent, equity to provide financing for change of ownership transactions, strategic acquisitions, recapitalizations and growth initiatives in partnership with business owners, management teams and financial sponsors. Saratoga Investment’s objective is to create attractive risk-adjusted returns by generating current income and long-term capital appreciation from its debt and equity investments. Saratoga Investment has elected to be regulated as a business development company under the Investment Company Act of 1940 and is externally-managed by Saratoga Investment Advisors, LLC, an SEC-registered investment advisor focusing on credit-driven strategies. Saratoga Investment owns two SBIC-licensed subsidiaries and manages a $650 million collateralized loan obligation (“CLO”) fund. It also owns 52% of the Class F and 100% of the subordinated notes of the CLO. The Company’s diverse funding sources, combined with a permanent capital base, enable Saratoga Investment to provide a broad range of financing solutions.