$105 Million Facility Increases Access to Affordable Funding for Thousands of Students Through Outcomes-Driven Underwriting

BOSTON, April 4, 2022 /PRNewswire/ — Stride Funding, Inc. (Stride) announced its partnership with Encina Lender Finance (ELF) and other top-tier credit funds to increase financial support for students pursuing high-impact bootcamp and certificate programs across the US. The $105 million senior credit facility will enable Stride to fund thousands more students pursuing alternative education in high-growth technology and trade fields.

Stride is the leading provider of Income Share Agreements (ISAs) for students across higher education and alternative education, and has already partnered with leading schools in the upskill space, including General Assembly and SV Academy. Charging ahead on their student-centric mission to provide flexible, affordable funding to learners of all backgrounds, Stride has pioneered outcomes-driven underwriting and thoroughly vets programs they partner with to ensure quality and a track record of strong career outcomes to support students.

“This partnership is a game-changer. This is the largest facility that’s ever been raised in the space. This marks a critical inflection point for the industry as credible, well-known investors enter the market to drive scalable, low cost capital and signal the increasing momentum of outcomes-based funding. These funding products are becoming mainstream and enable students of all backgrounds to get access to pursue meaningful careers,” stated Tess Michaels, Stride Funding’s Founder and CEO. “Through this partnership, we’ll be able to fund thousands of students from virtually any high-quality bootcamp or certificate program across the U.S. while doubling down on our mission to reshape education. Together, we will drive economic mobility for students previously locked out by traditional private loans.”

“Encina Lender Finance is thrilled to partner with the team at Stride Funding,” said Alex Knowland, Vice President at ELF. “Stride continues to be a leader in the alternative student lending industry and has a demonstrated history of success in the space as an originator and operator. We look forward to supporting them in their core mission of providing flexible financing solutions to students from all backgrounds and fueling economic mobility through not only higher education, but alternative education and upskilling programs.”

ELF and other top-tier credit funds join leading impact investors, including Ascendium Education Group, Inc., Juvo Ventures, and Strada Education Network, in supporting Stride’s ISA fund. This fund opens doors and strong career pathways to students who may not otherwise be able to find financing. Unlike the 92% of private loans that require students to find a creditworthy cosigner or co-borrower, Stride does not require current income, a minimum credit score, or a cosigner when determining student eligibility. Additionally, Stride’s award-winning platform offers end-to-end support—from application, underwriting, and origination, through servicing and personalized career support.

This mission to fund and empower students without cosigners is at the heart of Stride’s product design and partnership with schools like General Assembly. Two-thirds of Stride’s own engineering team graduated from bootcamp programs.

Lisa Lewin, General Assembly’s CEO, added, “Since launching our partnership in 2021, Stride’s ISAs have been a pivotal tool in making our immersive programs more accessible for students from diverse backgrounds. This monumental facility will allow even more students across the US to transform their lives and careers through skill development.”

Tilda, a software engineer who received a Stride ISA and graduated from General Assembly’s Computer Software Engineering Certificate program in 2020, says, “A traditional loan was unattainable to me, especially since I did not have a cosigner. With interest payments and no downside protection, failing to earn enough could put me in a serious debt problem. Thanks to the GA/Stride Catalyst Program, I was able to safely finance the cost of an online certificate course at General Assembly. I paid little-to-nothing upfront, my monthly payments are based on my current income, and I don’t pay any interest. My ISA reduced the financial risk of education, so I could focus more on learning and growing.“

Students seeking funding from Stride can access the student application portal, where they can receive a quote in less than 30 seconds to determine if a Stride Funding ISA is right for them. Bootcamps and alternative education programs interested in learning how Stride can help support their students can email hello@stridefunding.com.

About Stride

Stride Funding, Inc. is a mission-driven company that helps students hit their stride–with flexible educational funding. Unlike loans that lock students into rigid repayment structures, Stride offers affordable repayments based on income. The company has been recognized as a visionary leader by FinTech analysts for its innovative funding arrangements and commitment to career support. Stride’s executive team includes professionals with experiences across SoFi, JP Morgan Chase, National Foundation for Credit Counseling (NFCC), Sallie Mae, Goldman Sachs, Uber, and Liberty Mutual; Stride’s board of advisors is composed of serial entrepreneurs and industry leaders. GSV Ventures, Slow Ventures, Strada Education, Juvo Ventures, Firework Ventures, and Flybridge amongst others have participated in previous funding rounds. Learn more at stridefunding.com.

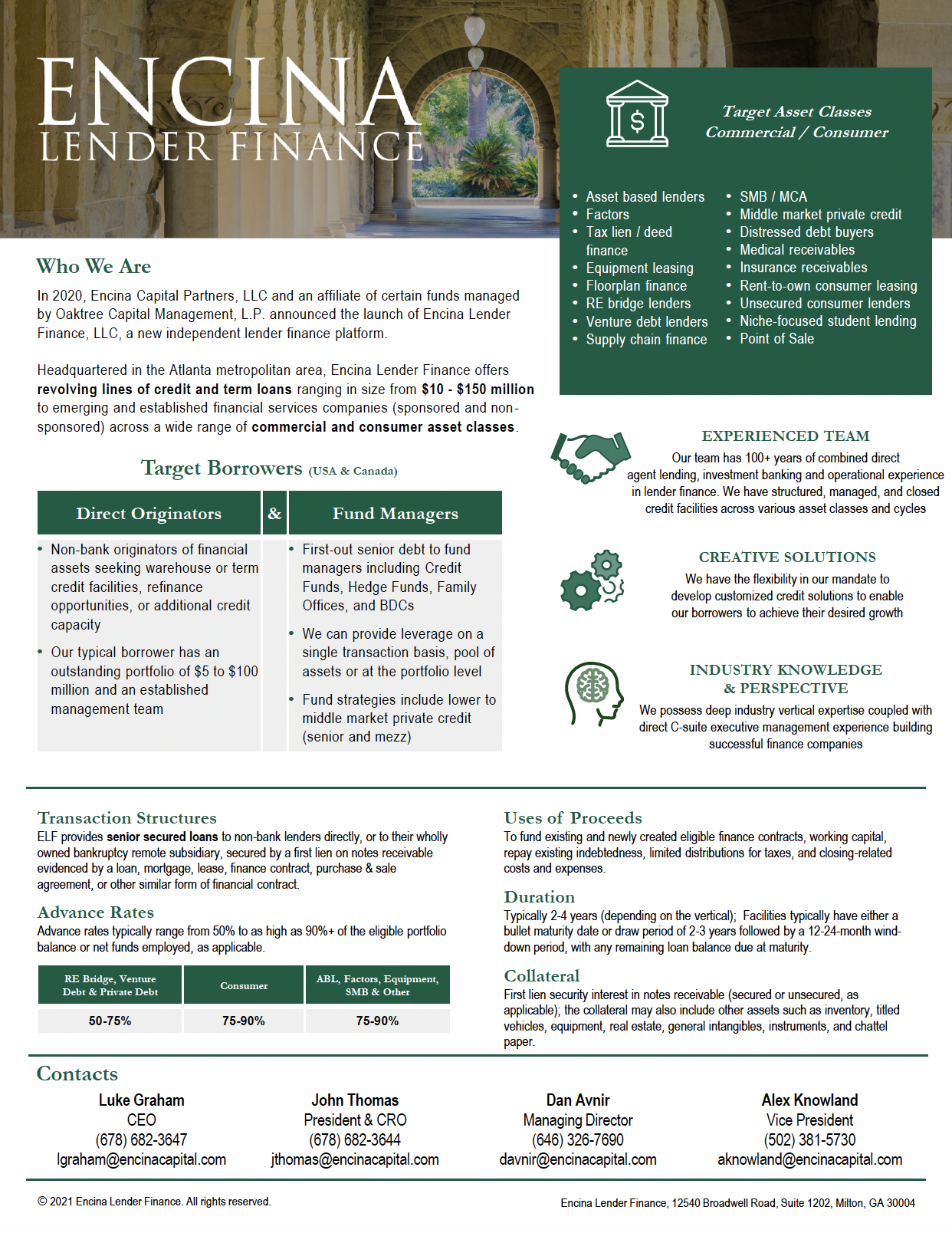

About Encina Lender Finance

Headquartered in Atlanta, ELF offers revolving lines of credit and term loans ranging in size from $10 to $150 million to specialty finance companies (sponsored and non-sponsored) across a wide range of asset classes including, but not limited to, asset-based lending, factoring, equipment leasing, floorplan financing, commercial real estate bridge lending, tax lien/deed financing, venture debt lending, SMB lending & merchant cash advance, middle-market private credit, charged-off debt buyers, rent-to-own consumer leasing, unsecured consumer lending and specialized student lending. ELF’s customers use financing proceeds primarily to fund the origination of new finance contracts and to refinance existing debt, and ELF’s loans are secured by portfolios of notes, loans and/or leases. For additional information, please visit ELF’s website at https://lenderfinance.encinacapital.com.